|

My quick money story. Everybody has one, right? Some people are born into money, some are not. Some people make a fantastic income and still struggle to pay their bills. Others make an average income and live comfortably within their means. Not many people talk about money. It's a secret. It now comes and goes in several icons on our devilish palm-sized devices (see my love hate relationship with my phone here). Anyway, my money story goes something like this: - average childhood, that's my parents' story to tell, but I never really felt STRESSED about money as a child and I was taught some good sound financial principles (thanks Mom & Dad) -got into > 40k in debt in my 20's by living above my means, keeping up with the Joneses and making poor financial decisions -spent 4 years of my 30's GETTING OUT OF DEBT which looked like paying $1000 /month towards old credit card debt FOR FOUR YEARS STRAIGHT (ouch!) -now I am in my 40's and focused on saving for retirement, paying our house off, and avoiding unnecessary debts I say all of that to say: I am not certified in anything financial. I have read some books and followed some financial influencers over the years, and I am very entrenched in our family's finances. I am also learning from my retired parents about what it will actually look like to live on a retirement income. I am familiar with Medicare, pensions, social security benefits, Roth IRAs, and 401k/403b plans. I am not a day trader or financial wizard. I'm somewhere in the middle, and I think that is probably where most of my readers are too. I have had to have very frank discussions about money with patients over the years (financial stress can GREATLY affect one's health and cause caregiver strain with children of elderly patients). So I decided to write about it. Part of my passion for writing is speaking the truth and shedding light on everything that is making us all stressed and uncomfortable. Now that you know my purpose for this piece, are you ready??? Let's do this! My 10 smart money tips for anyone, anywhere:

Let's go through each Money Tip in more detail so that we have a better understanding of them.

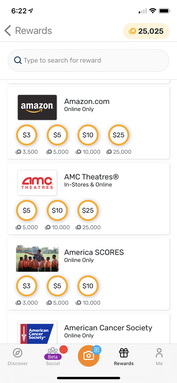

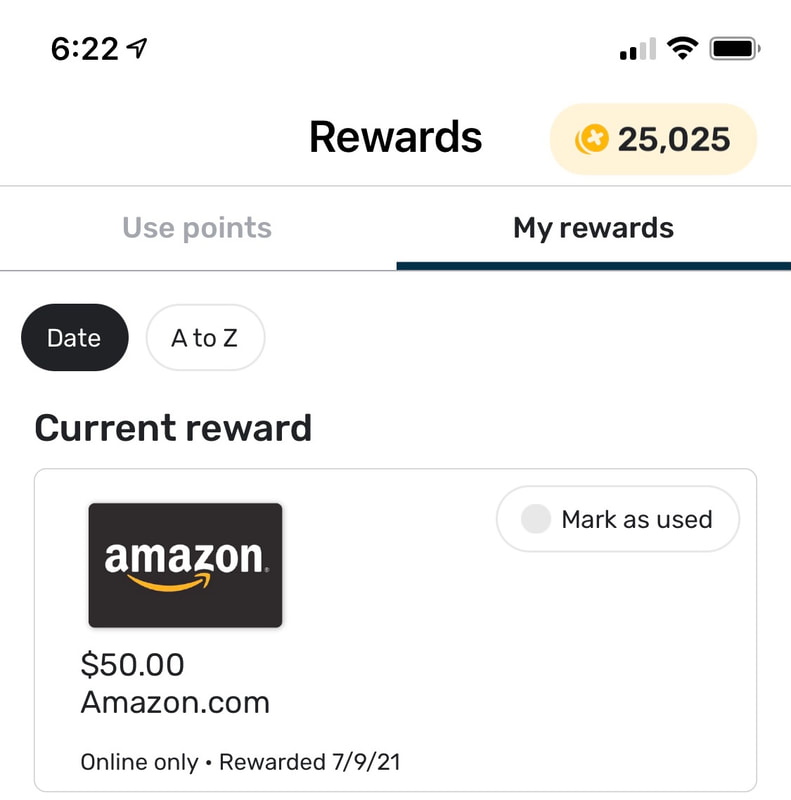

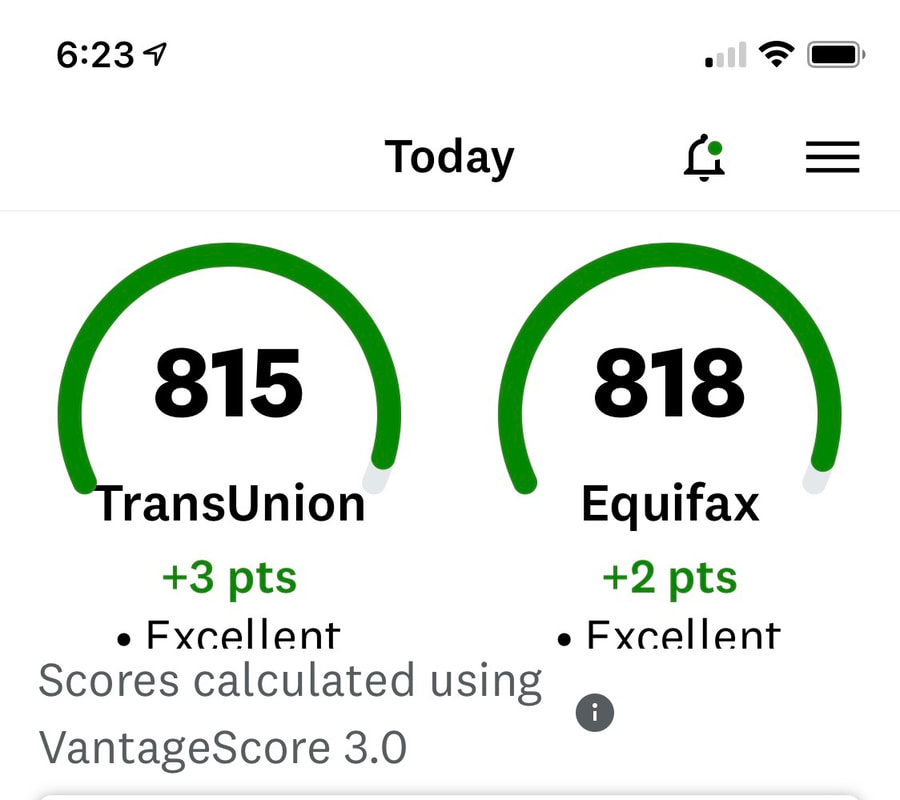

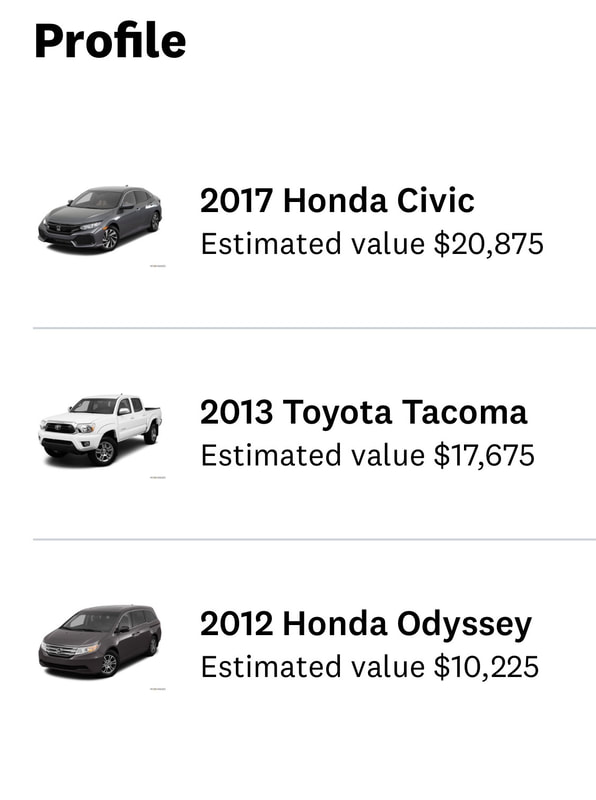

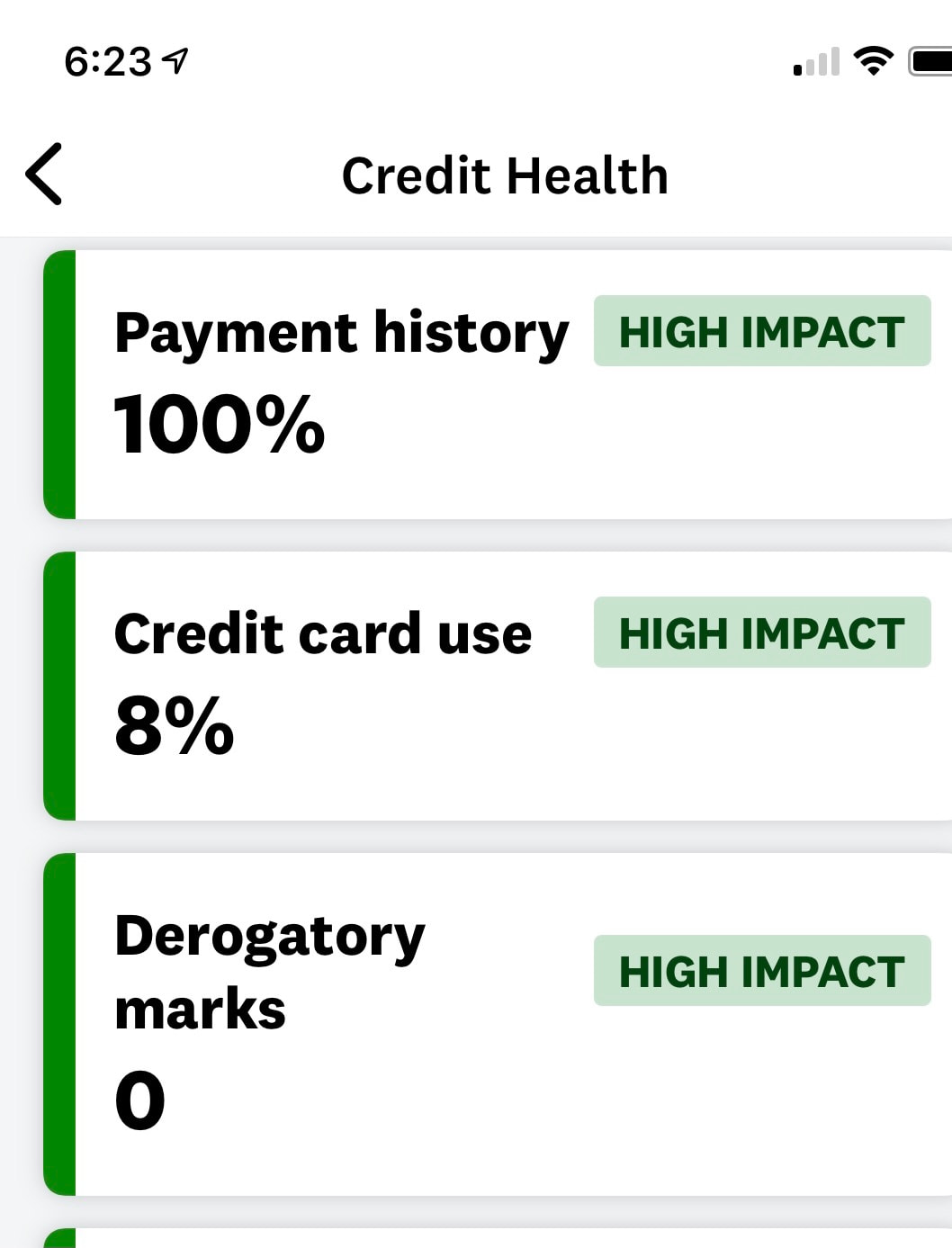

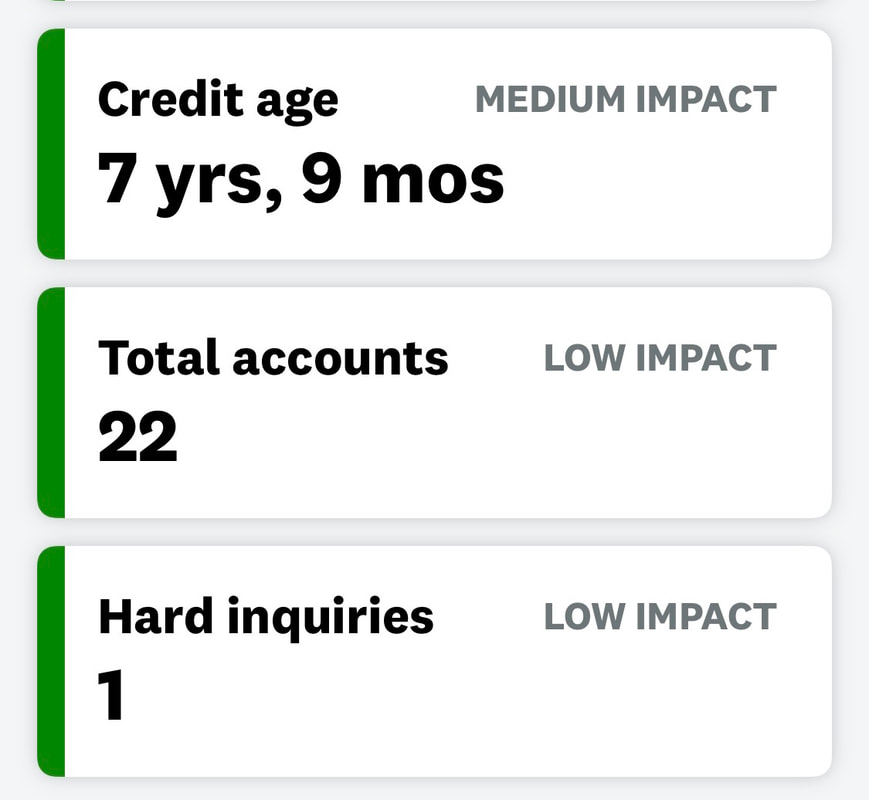

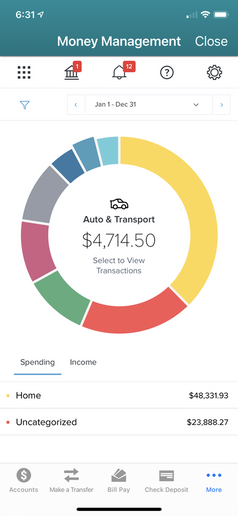

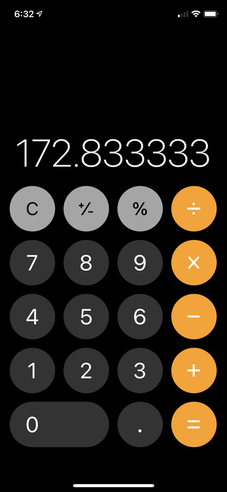

PRO TIP: The pictures below are just an example of using my banking app to monitor my spending. You can see the pie chart is for ALL of my 2021 spending. Since I don't have a car payment, I divided my auto expenses by 12. That came to around $392. Since I know car insurance makes up around $200 of the $392, I calculated that I am spending around $172 / month on gas. This is just an easy example of using your banking app to see what you are ACTUALLY spending on categories in your budget. What you think you spend and what you actually spend are often 2 very different amounts. So do your research! It costs you nothing to look at your spending and it will give you so much insight to your financial health! I did not write this post to provoke guilt or shame about your spending or finances. I have had 40k+ in debt and I have felt that overwhelming burden. It's just part of my story, and I am no longer ashamed of it.

0 Comments

Leave a Reply. |

Proudly powered by Weebly